Introduction

New Zealand is currently experiencing an alarming increase in company liquidations. This trend has sent ripples through various sectors, leaving many creditors scrambling to recover unpaid debts. In this blog, we will explore the reasons behind this surge, its implications, and why acting quickly to collect overdue debts has never been more critical.

Understanding Liquidation: A Brief Overview

- What is Liquidation?

Liquidation occurs when a company closes down and its assets are sold to pay creditors. - Types of Liquidation

- Voluntary liquidation initiated by shareholders or directors.

- Court-ordered liquidation due to insolvency.

Current Trends in New Zealand’s Liquidations

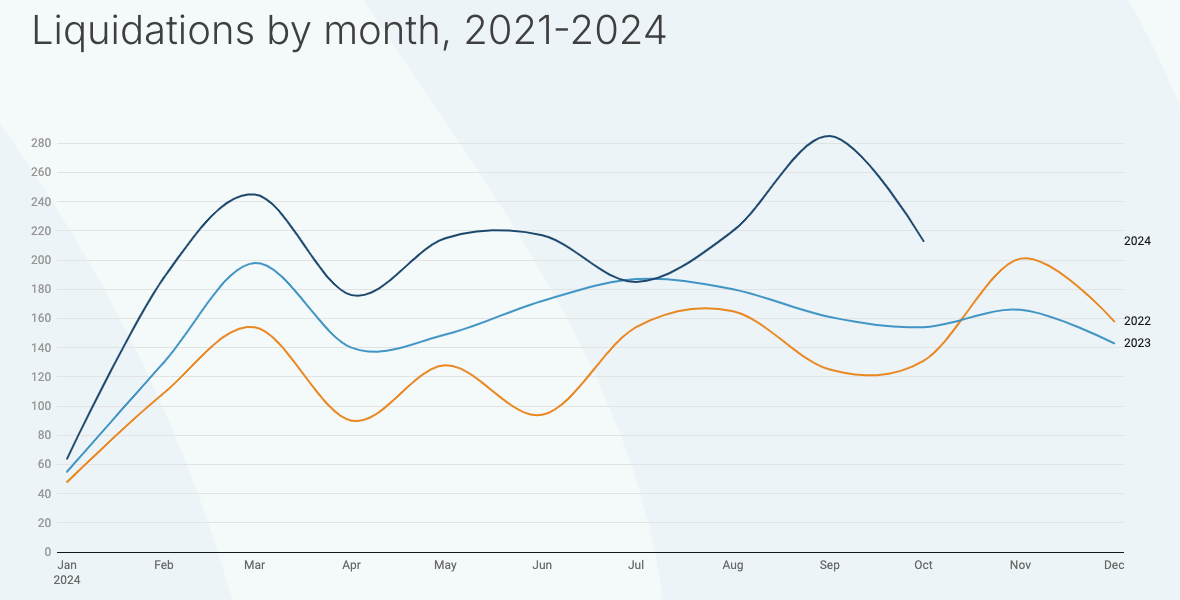

- Statistics Highlighting the Issue

Recent data reveals a significant year-on-year increase in company liquidations. Reports suggest that court-appointed liquidations have also seen a noticeable rise, particularly over the past six months. While precise numbers fluctuate, estimates indicate hundreds of businesses, particularly in vulnerable sectors like construction and retail, have been affected. - Key Sectors Affected

Construction, retail, and hospitality industries have seen the highest liquidation rates. - Post-Pandemic Challenges

- Lingering effects of COVID-19 on small businesses.

- Supply chain disruptions and rising operational costs.

Reasons Behind the Surge in Liquidations

- Economic Slowdown

Global inflation and economic uncertainty have strained businesses. - Increased Cost Pressures

Higher interest rates and operational costs are squeezing profit margins. - Delayed Payments

Cash flow issues often cascade when businesses fail to settle their dues promptly.

The Ripple Effects on Creditors

- Unsecured Creditors at Risk

Unsecured creditors are often left with little to no recovery after liquidation. - Impact on Small Businesses

For small creditors, unpaid debts can lead to severe financial distress.

Why Prompt Debt Collection is Crucial

- Avoiding the Bottom of the Payment Queue

Late action could mean your claim ranks lower than others. - Maximizing Recovery Potential

Early engagement increases the chances of debt recovery before assets are depleted. - Mitigating Further Risks

Proactively managing overdue accounts helps maintain healthy cash flow and reduces exposure to risky clients.

Effective Strategies for Debt Recovery

- Regular Account Monitoring

Identify overdue accounts early to address payment issues. - Clear Communication Channels

Maintain open communication with debtors to facilitate resolution. - Engaging Debt Collection Professionals

Specialized firms can negotiate and recover debts more effectively.

How Swiss Credit Consultants Can Help

Swiss Credit Consultants provides a structured and effective debt recovery process designed to maximize the chances of recovering overdue debts. Their approach includes:

- Tailored Debt Recovery Solutions: Customized strategies based on the specifics of each case.

- Expert Negotiation: Leveraging experienced professionals to engage with debtors.

- Legal Support: Offering comprehensive assistance with statutory demands and court actions when required.

- Transparent Reporting: Keeping clients informed at every stage of the recovery process.

By working with Swiss Credit Consultants, creditors can rely on professional expertise to recover debts efficiently and reduce financial exposure.

Legal Options for Debt Recovery

- Issuing Statutory Demands

A formal request can pressure the debtor to pay before liquidation proceedings begin. - Pursuing Court Action

For larger debts, legal action might be necessary to secure a claim. - Considering Mediation or Arbitration

These options can resolve disputes faster and more amicably.

Preventing Future Payment Issues

- Conducting Credit Checks

Assess the financial stability of potential clients. - Setting Clear Payment Terms

Include penalties for late payments in your contracts. - Establishing a Credit Policy

Define the scope and limits of extending credit.

The Role of Professional Advisors

- Accountants and Insolvency Experts

Leverage professional advice to navigate complex insolvency situations. - Debt Recovery Specialists

Expert teams can help you secure payments efficiently.

Conclusion

The surge in liquidations across New Zealand underscores the importance of proactive debt collection. Acting swiftly and strategically not only improves recovery chances but also safeguards your business’s financial health. By partnering with specialists like Swiss Credit Consultants, you can enhance your chances of successful debt recovery and ensure financial stability. As the economic landscape remains uncertain, staying vigilant and prepared is the best defense.

FAQs

1. What should I do if a debtor is going into liquidation?

File a claim with the liquidator as soon as possible and seek legal advice to maximize recovery chances.

2. Can I recover debts after a company has been liquidated?

Recovery is possible but often limited. Secured creditors are prioritized, while unsecured creditors may receive only partial repayment or none at all.

3. How can small businesses avoid overdue debts?

Implement credit policies, conduct due diligence on clients, and follow up on overdue accounts promptly.

4. Are there any government resources for creditors?

Yes, New Zealand’s Companies Office provides resources on insolvency and debt recovery.

5. What is the typical timeline for recovering debts?

Timelines vary depending on the debtor’s financial situation and the chosen recovery approach.